Triple Bottom Line theory is an essential tool to support sustainability goals because it focuses on comprehensive investment results concerning performance along with the interrelated dimensions of profits, people, and the planet.

Now, let us apply the same to 21st-century organizations. Even companies are much more than their revenues or the profits they generate for their stakeholders. Besides being financially sustainable, successful organizations are known for their performance on several different parameters. These could include their contributions to the socio-economic progress of communities and their outlook towards resource conservation. It is not only profit that defines the identity of an organization.

This approach to defining corporate accountability can be attributed to the Triple Bottom Line philosophy. According to this theory, the accurate measurement of a company’s accomplishments is not limited to only financial profits but also other non-quantifiable aspects and activities. Hence, the entity should pay equal attention to social and environmental concerns which also relate to its economic gains.

What is the ‘Triple Bottom Line’ approach?

In 1994, John Elkington—the famed British management consultant and sustainability guru—coined the phrase ‘Triple Bottom Line’ as his way of measuring performance in corporate America. The idea was that a company could be managed in a way that not only makes money but also improves people’s lives and the planet.

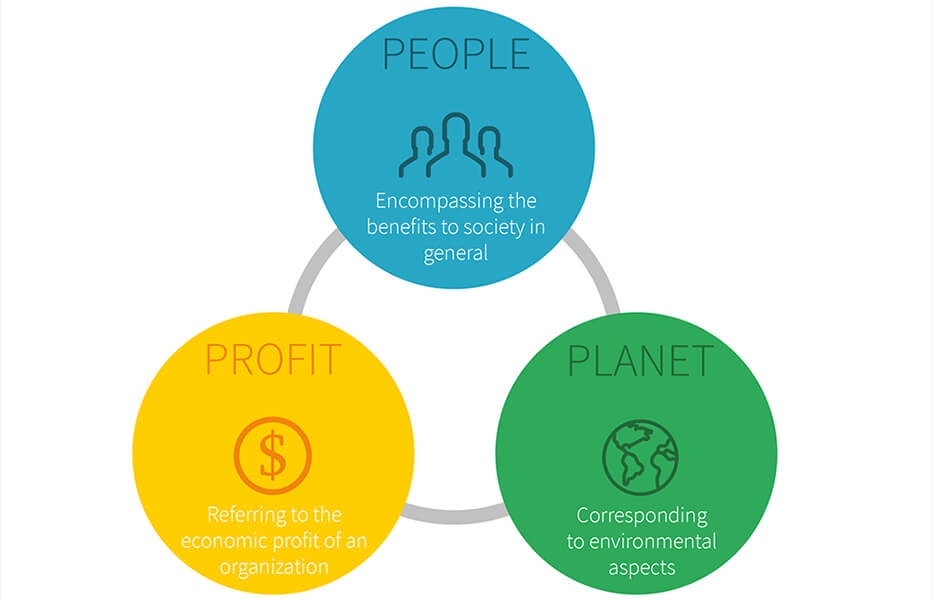

Holistic and sustainable progress is possible only when organizations balance economic, social, and environmental considerations. According to the Triple Bottom Line theory, companies should be working simultaneously on these three bottom lines:

- Profit: The traditional measure of corporate profit—the profit and loss (P&L) account.

- People: The measure of how socially responsible an organization has been throughout its history.

- Planet: The measure of how environmentally responsible a firm has been.

The relevance of the Triple Bottom Line framework amid a pandemic

“Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs.

– Brundtland Commission Report (1987)

Businesses that followed the Triple Bottom Line accounting framework are well-prepared for the pandemic’s aftermath and operating amid the new normal. David Deziel of Antioch University says that these organizations have multiple advantages over their non-conforming counterparts.

According to him:

1. Consumers will look to do business with companies that served their communities ethically during this difficult time.

2. Companies that follow the triple bottom line framework are durable in good times and bad – as proven by their stable returns during the crisis and high returns before the pandemic.

3. Investors are starting to realize that companies that behave in these ways are positioning themselves better for the future.

Benefits accrued through the Triple Bottom Line framework

Today, nearly three decades after Elkington conceptualized the framework; there is still no universal standard for measuring the three categories. According to a research paper published by Kelley School of Business: Indiana University, proponents of the triple bottom line framework have adapted many means to make an index — “both comprehensive and meaningful and how to identify suitable data for the variables that compose the index.” The paper sites examples such as the Genuine Progress Indicator (GPI). The GPI consists of 25 variables that encompass economic, social, and environmental factors. Those variables are converted into monetary units and summed into a single, dollar-denominated measure. However, monetizing all the framework dimensions is not an effective strategy because not all impact can be measured financially. According to Elkington, “success or failure on sustainability goals cannot be measured only in terms of profit and loss. It must also be measured in terms of the wellbeing of billions of people and the health of our planet, and the sustainability sector’s record in moving the needle on those goals has been decidedly mixed.”

Contrary to common perceptions, the variability in its measurement parameters’ is the reason for the triple bottom line framework’s longevity and universal adaption. This flexibility of the approach “can be viewed as a strength because it allows a user to adapt the general framework to the needs of different entities (businesses or non-profits), different projects or policies (infrastructure investment or educational programs), or different geographic boundaries (a city, region or country)…the level of the entity, type of project and the geographic scope will drive many of the decisions about what measures to include.”

Another example cited in the research by Kelley School of Business: Indiana University is the case of the state of Minnesota in the USA. Minnesota’s progress indicator comprised 42 variables that focused on a healthy economy’s goals and gauged progress in achieving these goals. Consequently, the framework is used by businesses, non-profits, and government entities alike.

Indeed, the triple bottom line has been a source of inspiration for many accounting and reporting frameworks, including the Social Return on Investment (SROI) and the ESG (a framework focusing investors and financial analysts on Environmental, Social, and Governance factors) among others.

Following the triple bottom line approach, which is proven to be a sustainable option, leads to more holistic development of businesses and long-term sustainability — the need of the hour. The ongoing economic crisis – caused by COVID-19 is an unprecedented moment for holistic reset. It has made us realize that each of us – in our individual and collective capacity- needs to take ownership of our future. The triple bottom line approach is one way towards a sustainable future for businesses. As we tread on the recovery path, we must remember that our choices will be essential determinants of creating sustainable national economies, societies, and businesses. Hence, we must use this window of opportunity wisely to shift our focus to build businesses that care for people and the planet along with profits.